What Is The Down Payment For A House In Bangalore

When buying a house in Bangalore or anywhere else, many financial things must be considered. The down payment is one of the most important. The down payment is the first payment a buyer makes upfront. It is a portion of the total value of the house. Bangalore's down payment requirements can change depending on the loan type, the property cost, and the lender's rules. This piece aims to give you a full picture of down payments for Bangalore homes.

-

How to Figure Out the Down Payment:

Several things affect how much down payment you need to buy a house in Bangalore. One of the main factors is how much the property costs altogether. Lenders usually want a down payment of a certain portion of the home's value. The type of home loan and the applicant's credit score are also very important. Rules and laws made by the government may also affect the down payment amount.

-

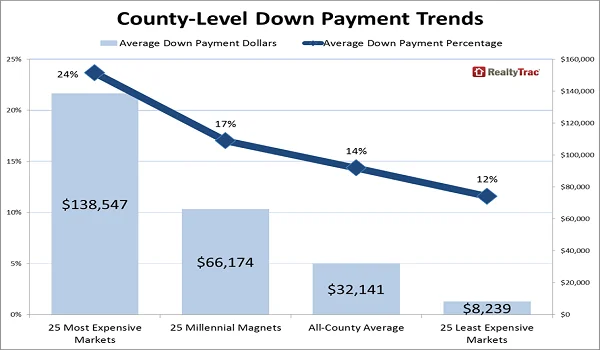

Average Percentage of Down Payment:

The down payment amount is usually between 10% and 20% of the house's total value. This is true in Bangalore as well as other places in India. This can change, though, depending on the lender and the loan. Some government-backed loans, like the Pradhan Mantri Awas Yojana (PMAY), may have better terms for down payments, meaning sellers can pay a lower percentage. People who want to buy a house should study lenders and loan choices to find the best terms for their budget.

-

How the price of the home affects the down payment:

The amount of the down payment is directly related to how much the house costs. More expensive properties will naturally need a bigger down payment. People who want to buy a home in Bangalore should carefully look at their income and the price of the house to figure out how much of a down payment they can safely make. The loan-to-value number that banks usually allow is limited. This means that the down payment will need to be bigger for more expensive homes.

-

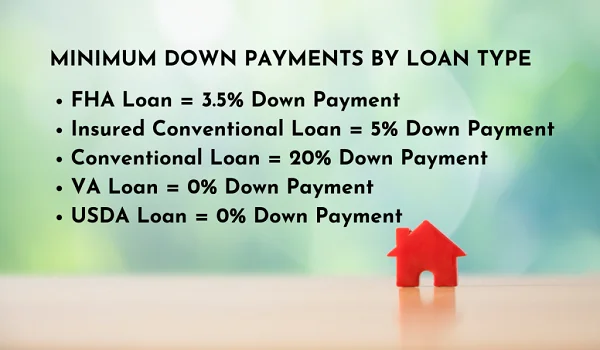

Different loan types and down payment amounts:

The buyer's choice of home loan can change the amount of the down payment. People who get government-backed loans, like those through PMAY or other state-specific programs, may have to make a smaller down payment. To make smart choices about down payments, you need to know the details of the different types of loans.

Conclusion:

Finally, the down payment on a house in Bangalore is a big financial decision that needs a lot of thought and planning. People who want to buy a house need to know about the things that affect the down payment, like the cost of the house, the type of loan, and the lender's rules. People can make smart choices about down payments and work toward their dream of owning a home in Bangalore by looking into different loan options, talking with lenders, and staying up to date on government-backed programs.

Birla Group prelaunch new project Birla Ojasvi

| Enquiry |